Following the long-awaited announcement of the first cut to the Official Cash Rate in more than four years by the Reserve Bank of New Zealand, market sentiment in Hawke’s Bay is lifting.

While the road to recovery following the economic shocks caused by the Covid-19 pandemic and extreme weather events such as Cyclone Gabrielle has been long, green shoots are emerging.

The RBNZ’s decision to cut the OCR in August has been received positively by investors and with further cuts likely before the end of the year, we expect to see interest rates continue to drop. While the impact of these cuts won’t be felt overnight, it will assist in leading us on a more positive path, which is becoming clearer across the country.

Some of that positivity is already filtering into our local market, as evidenced by a collection of recent transactions. July produced a mixture of on-market and off-market deals for our office that resulted in the second-biggest month recorded by Colliers Hawke’s Bay’s commercial and industrial team.

To put that in perspective, Colliers has been operating in Hawke’s Bay for 20 years as of August 2024, so this was certainly noteworthy.

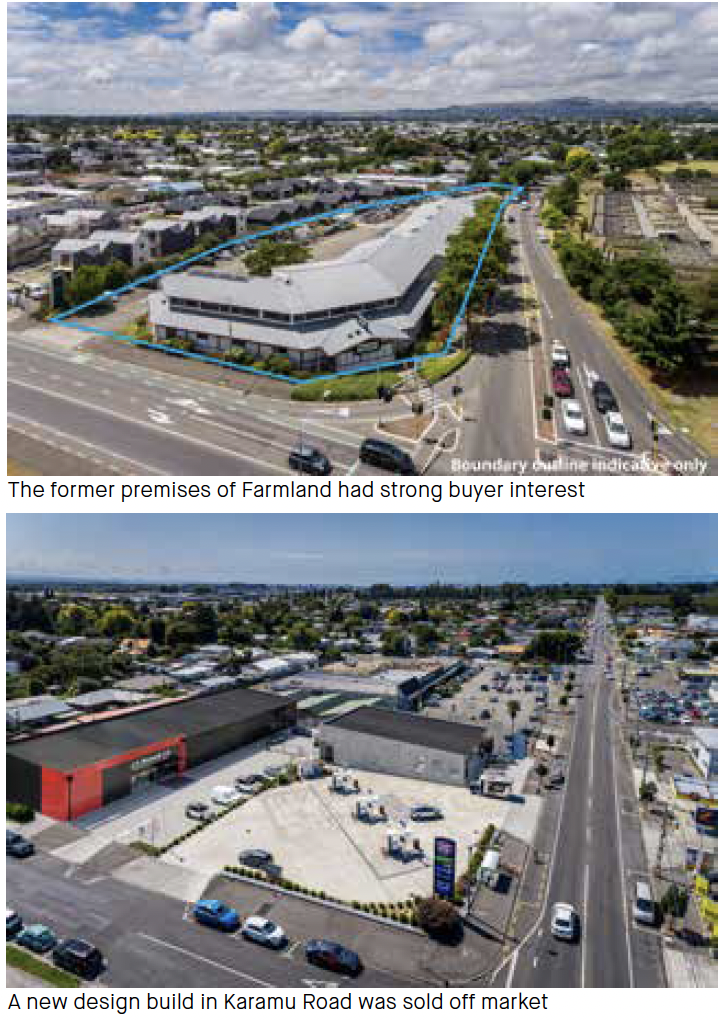

During the past few months, our team has transacted some major deals across Hawke’s Bay, including the former Farmlands building at 210 Maraekakaho Road, an office and trade retail property that occupies a high-profile corner location in Hastings. This campaign had very strong competitive local interest, with multiple offers received at the deadline. Another recent off market sale was a new design build leased to J.A. Russell on a new ten-year lease, with an additional 519m² trade retail tenancy with frontage onto Karamu Road, Hastings. This has sold off the plans at a yield of 5.4% or $7,757M.

Crucially, we are starting to see the expectations of vendors meeting those of buyers, which will ultimately lead to more transactions. Given the dormant nature of the market for the past 18 months, vendors now have clear data to work with around the prices that are being achieved.

Those who have made purchases recently have done so at the likely bottom of the cycle and certain strategic acquisitions could provide significant value in the future. The property market remains cyclical and we will potentially enter an upswing shortly so now is the time for investors to assess their options as we move towards the final quarter of the year.

Although it is outside the commercial and industrial realm, I have watched with interest the recent sales of orchards within the region. It is a huge boost for the area that foreign capital is being directed into Hawke’s Bay and it will drive future investment and create jobs in the area. Cyclone Gabrielle was particularly harsh on our horticulture sector and I look forward to watching it bounce back stronger than ever in the future.

I am also watching with interest the Hastings and Napier Future Development Strategy (FDS) which based on growth will identify new areas for residential, industrial and commercial development in Hastings and Napier out to 2055. Watch this space for some views on the FDS in the next issue.